Dedicated to funding your liquidity and deposit needs

Since 1988, Multi-Bank Securities, Inc. has offered experience in funding and liquidity alternatives to FDIC- and NCUA-insured financial institutions.

We continue to expand our capabilities and services with the goal of becoming a reliable and diverse source of wholesale deposits. Our commitment to achieving this goal allows us to offer you the following services:

Products

- DTC-Eligible CDs (Brokered Deposits)

- Fixed-Rate/Terms (Bullets)

- Callable CDs

- Variable Rate Deposits

- Direct Deposits (“Physical CDs”)

- Referred CDs

- Listing Service CDs

- Nonmember Deposits

- Internet CDs

- Public Funds

- Collateralized Deposits

Services

- Pre-Orders

- Published Rates and Offerings

- Online Order Processing

- Underwriting and Distribution

- Physical CD Rates

- Balance Sheet Liquidity

- End-Account Sales

- Unique Liquidity Resources

- Online Investing and Funding Platform

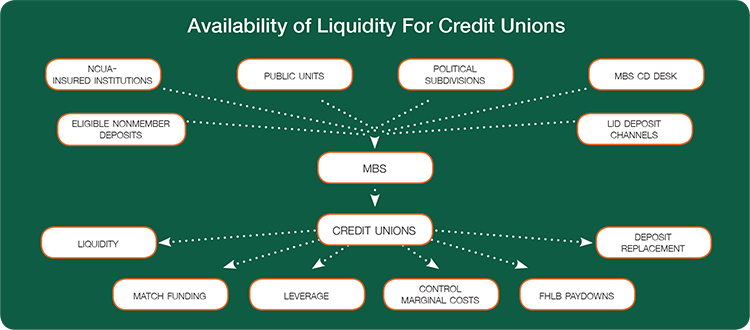

Availability of Liquidity

Multi-Bank Securities, Inc. (MBS) is committed to providing an ongoing pool of liquidity to tap into as your needs prescribe. As each source of liquidity runs in different cycles, we feel it is important to offer our clients continued access to each circle of funds. When issuing through our Funding Desk, our clients have come to expect not only a competitive cost of funds, but also the confidence that their orders are filled in a time frame that meets their expectations.

To learn more about contingency funding alternatives available to credit unions, read FMS Forward‘s Contingency Questions, featuring MBS Senior Vice President Tim Peacock.

Performance, Experience and Perspective

MBS offers years of experience in funding, underwriting and distributing CDs and other fixed-income products and services. The highest priorities for the members of our Funding Desk are to learn your specific needs, manage and define realistic expectations, offer value-added guidance with regard to issuing in the brokered CD markets and to provide you the required amount of funds at the lowest possible cost. We continue to expand our product mix, deposit sources and services with the goal of maintaining our reputation of being a reliable and diverse source of wholesale deposits.

Our liquidity is provided to you by more than 3,000 MBS institutional accounts, three industry trade platforms and more than 500 regional and national broker-dealers. Our active approach toward marketing your rates and funding our issuance pipeline has provided deposits for more than 2,000 financial institutions, representing billions of dollars in outstanding maturities.

Our continued goal is to be able to provide our customers a stable flow of deposits and to demonstrate the credibility, service and reliability that our clients deserve.

Cost of Funding

All wholesale CD programs, and the cost associated with them, are affected by the ongoing availability of deposits. MBS is committed to providing you with a diverse source of wholesale deposit solutions to allow you to take advantage of different market cycles. We will continue our ongoing effort to build our sources of funding so that we may provide you with competitively-priced deposits in any of our CD programs. For current rates and offerings, please call (866) 355-0109 or email underwriting@mbssecurities.com.

Customer Service and Support

You are the customer and we are the provider of funds. Since 1988, we have committed to being a “high-tech/high-touch” firm. MBS has a dedicated Funding Desk that covers the funding and liquidity needs of issuing financial institutions and depositories in all 50 states.

We are your conduit into the wholesale markets and offer direct access to thousands of CD investors. We are available to meet or speak with you and/or ALCO committee members to discuss the process and benefits of issuing wholesale deposits, to answer your questions, to fulfill your due diligence and compliance requirements, and to provide guidance, pricing suggestions and market-driven strategies in an effort to meet your liquidity needs. We are equally committed to being available during the middle and end of any CD transaction to provide the customer service and support that needs to take place between all involved parties.

Why MBS?

Reliability, customer service, competitive pricing, availability to liquidity, flexible offering periods and product diversification are a small list of reasons why banks and credit unions choose to use MBS for their brokered CDs and wholesale funding needs.

Our commitment is to you and to being a leader in the brokered CD business.